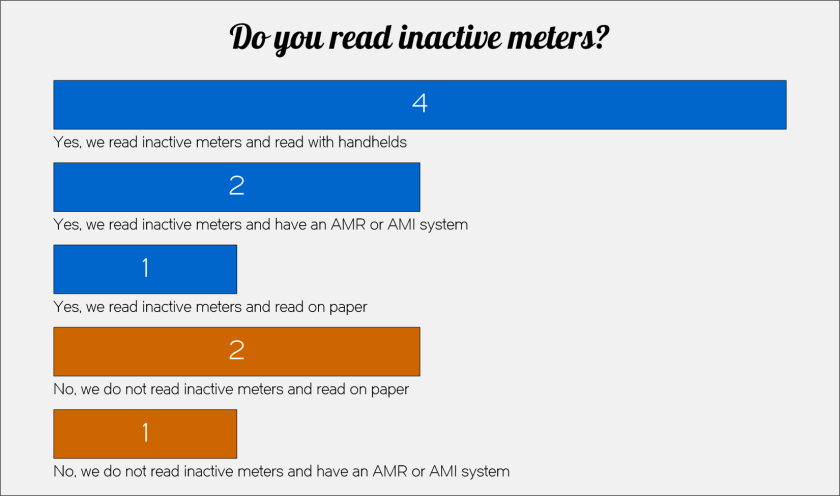

This is the first in what I hope becomes a regular feature of the Utility Information Pipeline that I’m calling “Reader Spotlights”. In each Reader Spotlight issue I will highlight an initiative undertaken by a reader of the Utility Information Pipeline.

Effective July 1 of last year, at the start of the current fiscal year, the City of Graham North Carolina changed the way they assess late fees and the amount they charge as a cut-off fee for non-payment. They also implemented, for the first time, a fee for initiating service.

Frankie Maness, Graham City Manager, said “Delinquent accounts have been a longstanding problem for the City and we have debated many times on methods to mitigate the costs. During this past budget season I ran across a Utility Information Pipeline from 2012 that indicated our fees, when compared to our peers, were way overdue for an update. With Gary’s assistance, we have now implemented changes and the results are starting to show increased revenue and a reduced burden from these accounts. At the same time, we implemented a Service Initiation Fee which has also generated additional revenue.”

With Gary’s assistance, we have now implemented changes and the results are starting to show increased revenue and a reduced burden from these accounts.

If you’re interested, here’s a link to the 2015 Utility Fee Survey results issue with more current data than the issue Frankie referenced above.

Let’s take a look at the changes they implemented…

Change in how late fees are calculated

Prior to July 1, Graham charged a flat $5.00 late fee to all customers, regardless of the amount of the past due bill. Effective July 1, they implemented a hybrid late fee of 2% of the outstanding balance with a minimum of $5.00.

For the period of July through December, this minor change in the way late fees are calculated impacted only 2.85% of the customers who were charged a late fee. However, it resulted in a 16.97% increase in revenue from those customers!

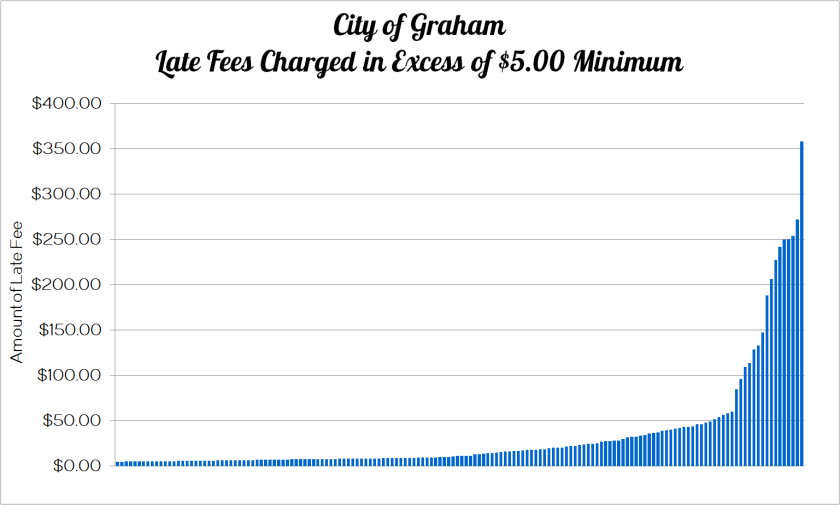

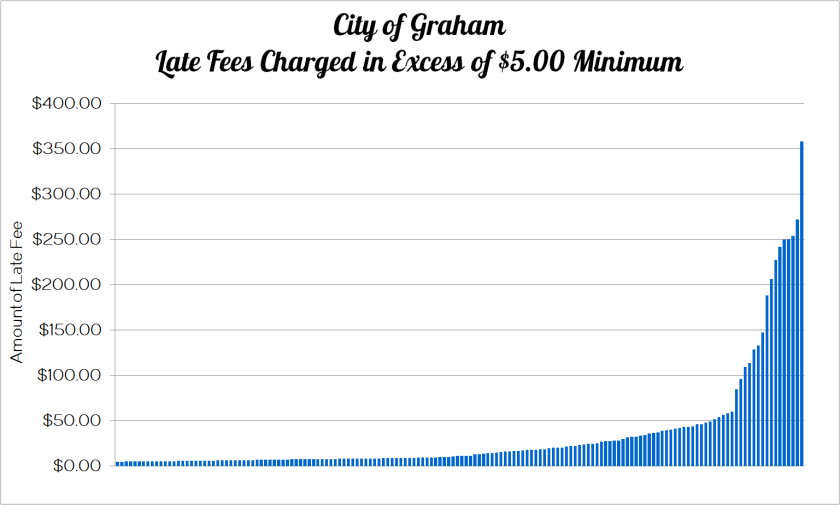

Here is a graph of the late fee amounts over the $5.00 minimum that were charged (clicking on the any of the graphics will open a larger image in a new window):

As you can see, nearly half of the customers who were impacted still paid $10.00 or less in late fees. However, the top 15 customers accounted for nearly $3,000.00 in increased revenue. In fact, in spite of the increased late fees, one account in the top 15 was still late every month! Your utility doesn’t have any customers like this, does it?

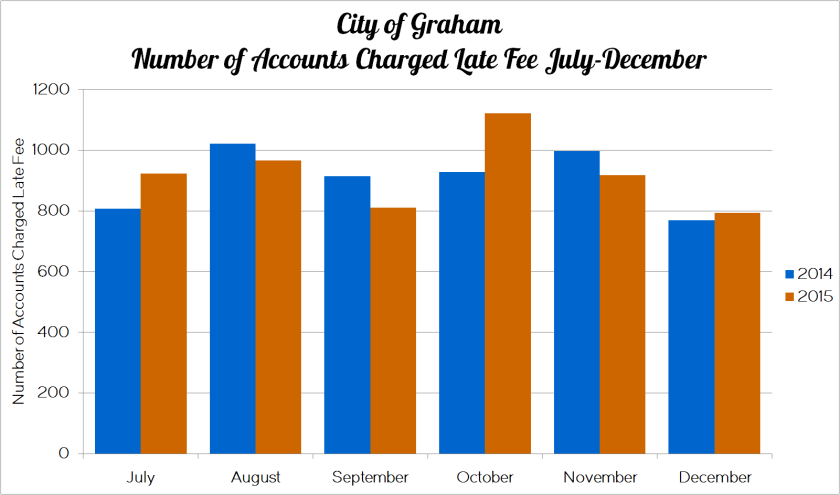

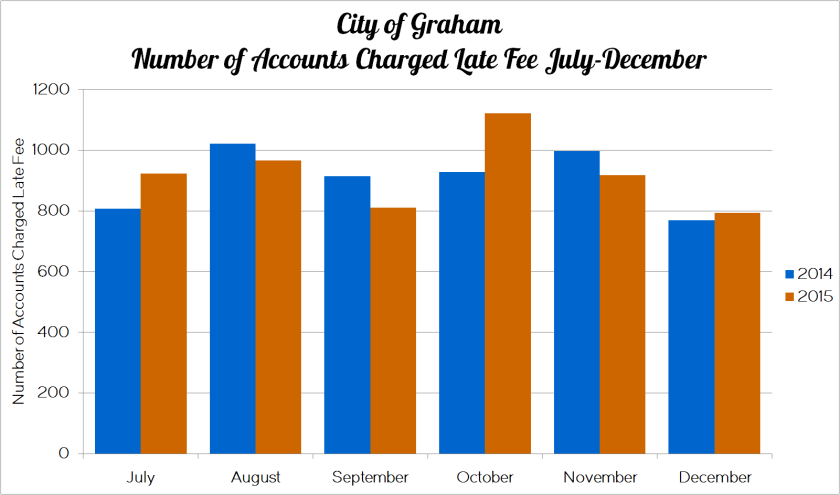

A month-by-month comparison of the same period from the previous year shows the number of accounts charged a late fee didn’t change appreciably:

In fact, over the same period, 95 more customers were charged a late fee in 2015 than 2014.

Increased cut-off fees

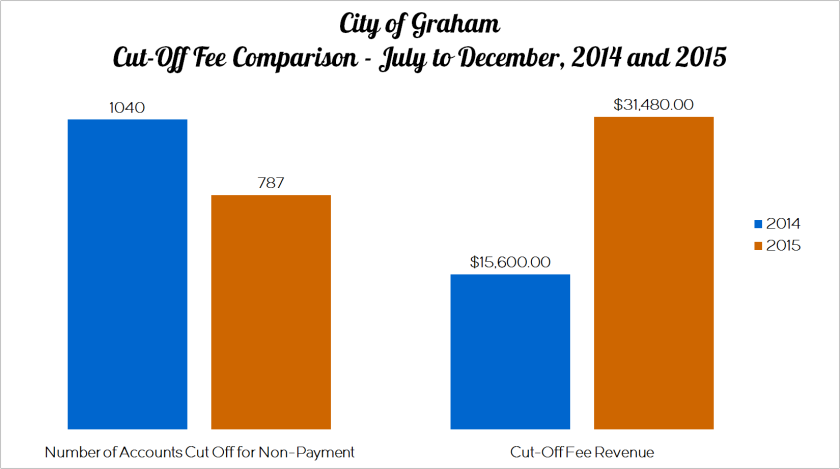

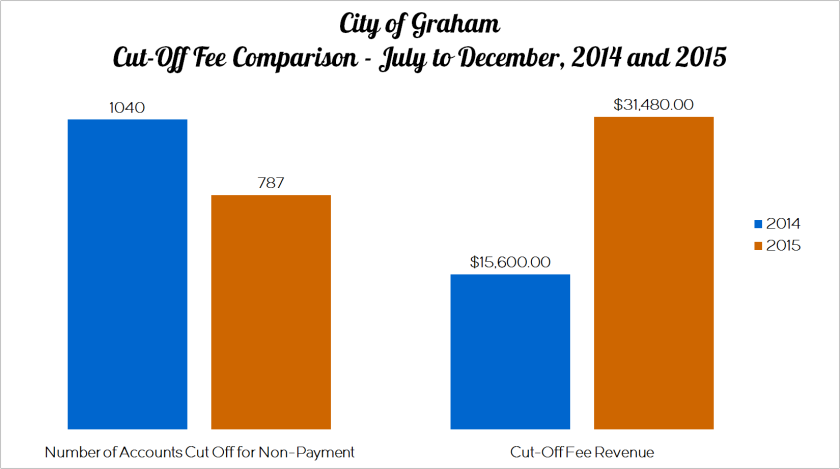

At the same time, Graham increased their cut-off fee (they wisely call it a Nonpayment Fee) from $15.00 to $40.00. This higher fee resulted in 24.33% fewer customers on the cut-off list generating 101.79% more revenue! The details are shown below:

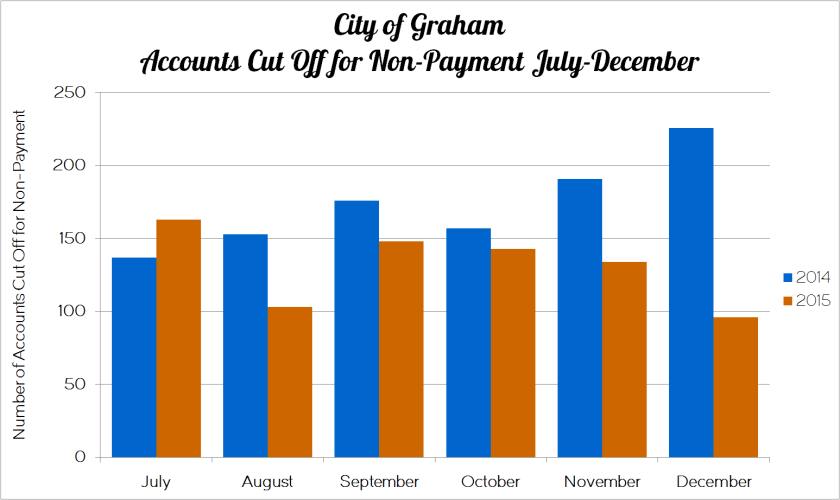

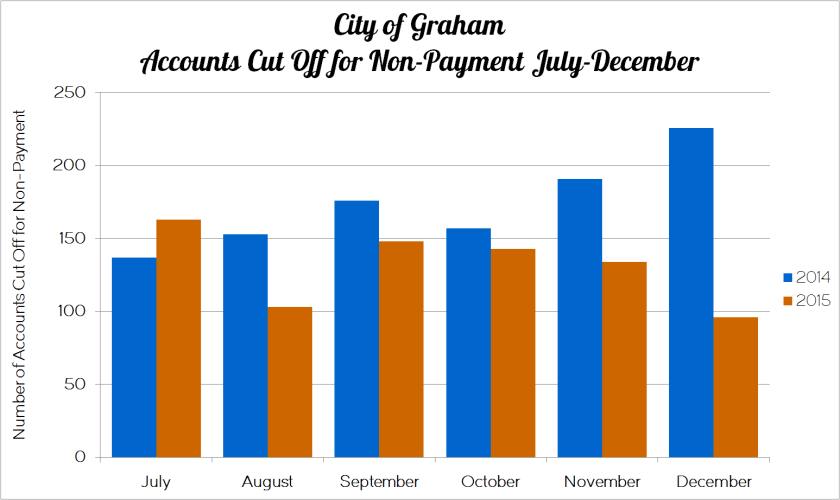

Unlike the change in late payment penalty, this increase in the nonpayment fee did have a significant impact on the number of customers on the cut-off list, as compared to the same period the year before:

Interestingly, the increased cut-off fee reduced the number of accounts on the cut-off list from 3.20% to 2.42% of Graham’s customer base. This moved them from the “room for improvement” to “normal range” on my acceptable range scale for accounts on the cut-off list.

New service initiation fee

The third initiative in the FY 2015-2016 budget for the City of Graham was the establishment of a Service Initiation Fee. This is an administrative fee charged to each new customer applying for utility service and is designed to recoup the cost of initiating service.

For the period of July through December 2015, this new fee generated $3,720.00 in additional revenue.

How up-to-date are your fees?

If, like the City of Graham, you think your fees may be outdated or in need of review, please give me a call at 919-232-2320 or e-mail me at gsanders@logicssolutions.com to learn how a business review could help your utility.

A special offer

To celebrate the inaugural Reader Spotlight issue, I’m offering a special offer to the first five Utility Information Pipeline readers who respond. If you are one of the first five to respond, I will conduct a personalized fee consultation for one-third off the regular price! That’s $1,000 rather than the usual $1,500 price for this service.

I will review your utility’s current fee schedule and conduct an in-depth phone assessment to learn more about your fees. You will receive a presentation quality document illustrating how your fees compare with other utilities. Also included will be my recommendations for revising any existing fees and suggestions of new fees you should consider charging.

If you are interested in this special offer, please contact me by calling 919-232-2320 or e-mailing me at gsanders@logicssolutions.com. Remember, the discounted special offer is only available to the first five people who respond.

Would you like to be featured in a Reader Spotlight?

Has your utility adopted new policies or streamlined procedures as a result of something I’ve written here or presented at a speaking engagement?

If so, please give me a call at 919-232-2320 or e-mail me at gsanders@logicssolutions.com to discuss including your initiative in a future Utility Information Pipeline.

© 2016 Gary Sanders